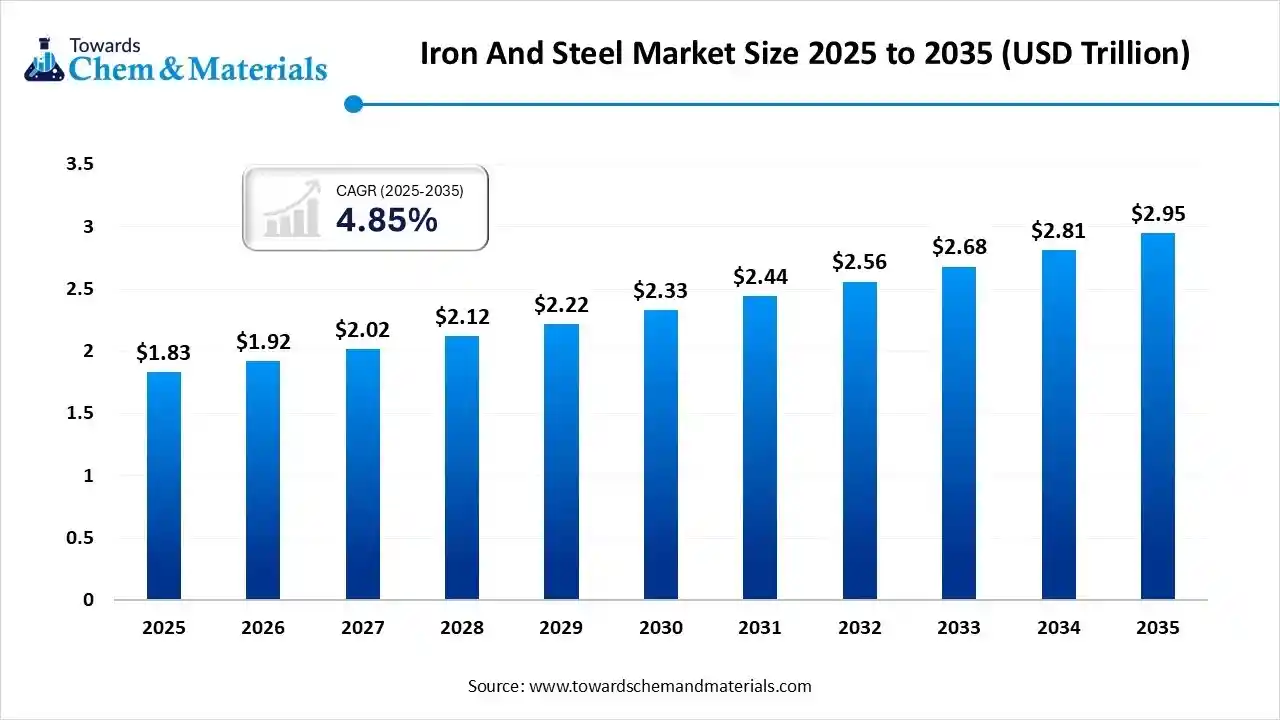

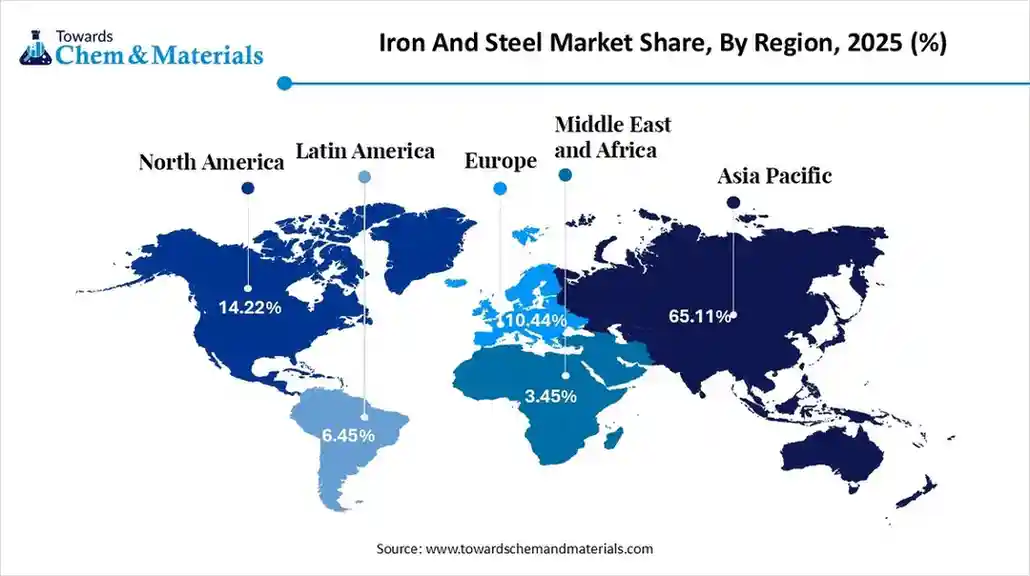

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) -- The global iron and steel market size accounted for USD 1.83 trillion in 2025 and is expected to be worth around USD 2.95 trillion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.85 % over the forecast period 2026 to 2035. Asia Pacific dominated the iron and steel market with a market share of 65% the global market in 2025. The iron and steel market is experiencing robust growth, driven primarily by rapid urbanization and large-scale infrastructure development, including roads, bridges, and commercial and residential buildings.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6027

What is Iron and Steel?

The global iron and steel market is witnessing steady growth, fueled by strong demand from construction, automotive, and industrial sectors. Rapid urbanization and infrastructure development, particularly in emerging economies, are driving the consumption of structural steel and long products. The automotive industry’s increasing production of vehicles and focus on safety and lightweight components is boosting the need for high-strength and specialty steels.

Growth in energy, machinery, and consumer goods sectors further supports demand for stainless and alloy steels. Additionally, technological advancements in steel production, recycling initiatives, and sustainability-focused policies are enhancing efficiency and reducing environmental impact, positioning the market for continued expansion.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Iron and Steel Market Report Highlights

- Asia-Pacific dominated the iron and steel market with a revenue share of 65% in 2025.

- By product type, the finished steel segment led the market and accounted for 55% of the global revenue share in 2025. The Iron market, segmented by production technology into Blast Furnace and DRI (Direct Reduced Iron) processes, is led by the Blast Furnace method due to its established large-scale output and efficiency. However, the DRI process is the fastest-growing segment, driven by rising demand for low-emission, energy-efficient, and sustainable iron production

- By steel type, the carbon steel segment accounted for the largest revenue share of 65% in 2025. Its dominance stems from widespread use in construction, automotive, and renewable energy sectors, driven by increasing demand for high-strength, lightweight, and sustainable material solutions globally

- By production method, the basic oxygen furnace (BOF) segment dominated with the largest revenue share of 60% in 2025. The Iron & Steel market, segmented by production technology into Basic Oxygen Furnace (BOF), Electric Arc Furnace (EAF), Open Hearth, and Others, is dominated by the BOF segment due to its high production capacity. Meanwhile, the EAF segment is the fastest growing, supported by increasing scrap utilization and global decarbonization initiatives

- By application, the construction & infrastructure segment dominated the market and accounted for the largest revenue share of 50% in 2025.

- By end user industry, the commercial & infrastructure construction segment accounted for the largest market revenue share of 45% in 2025. The Iron & Steel market, segmented by end-use industry into Building & Construction, Automotive & Transportation, Mechanical Equipment, Metal Products, and Others, is dominated by the Building & Construction sector. It remains the largest and fastest-growing segment, driven by rapid urbanization, infrastructure modernization, and sustainable building material demand worldwide

- The major market players have adopted both organic and inorganic strategies, including partnerships and investments ArcelorMittal (Luxembourg), China Baowu Steel group Corporation Limited (China), TATA Steel (India), JSW (India), Nucor Corporation (US) , NIPPON STEEL CORPORATION (Japan), Ansteel Group Corporation Limited (China), POSCO (UK), HBIS Group (China), and SAIL (India) are entered into number of agreements and partnerships to cater the growing demand for iron & steel across various end-use industries.

What Is The Role Of Iron And Steel In Clean Energy Transitions?

Steel production is highly reliant on coal, which is primarily used as a reducing agent to extract iron from iron ore and to provide the carbon content needed in steel. Over the past decade, total CO2 emissions from the iron and steel sector have risen, largely owning to increases in steel demand. The direct CO2 intensity of crude steel production has decreased slightly in the past few years, but efforts need to be accelerated to get on track with the pathway in the Net Zero Emissions by 2050 Scenario.

Why Is Iron and Steel Important?

Driven by population and economic growth, global demand for steel has been growing strongly in recent years and is expected to continue to increase, especially because of economic expansion in India, ASEAN countries and Africa, even as demand in China gradually declines.

Types of Iron

As previously said, pure iron isn’t really useful since it’s very soft and reactive. However, its properties are greatly enhanced when it’s alloyed with other metals and non-metals. Thus, all materials that people broadly refer to as iron are actually different types of iron-based alloys. There are several types of iron:

- Pig Iron — Pig iron is iron in its basic, raw form, which is molded into blocks, otherwise known as pigs.

- Cast Iron — cast iron is an alloy with very high carbon content, which is melted, poured, and allowed to cool and harden. It’s often used for producing structural shapes.

- Wrought Iron — wrought iron has a lower carbon content and plenty of impurities, which makes it softer than cast iron, allowing you to reheat and reshape the metal.

History of Iron Production

Iron was undoubtedly known to the ancient world, and one of the earliest examples is beads made from meteoritic iron ore dating back to 3,500 BC Egypt. Mankind didn’t extract iron from the Earth due to a lack of technological knowledge, so they associated this metal with heavenly origins. Egyptians continued to work with meteoritic iron until 2,500 BC.

At the same time, samples of smelted iron can be found in Asmar, Mesopotamia, and Syria, dating between 3,000 and 2,700 BC. The Hittites were among the first to smelt iron between 1,500 and 1,200 BC, and it’s likely that the practice of iron smelting spread throughout the rest of the ancient world, ushering in the Iron Age.

Cast iron first appeared in the 5th century BC in China but was hardly used in Europe until the medieval period. Cast iron eventually replaced wrought iron towards the end of the 18th century, when its use became incredibly widespread, furthering the development of construction, transportation, and numerous other industries.

Read More News : Carbon Steel Market Size to Worth USD 1.80 Trillion by 2035

Read More News : Flat Steel Market Size to Hit USD 1,157.84 Billion by 2034

Read More News : Structural Steel Market Size to Surpass USD 188.63 Billion by 2034

Read More News : Stainless Steel Market Size to Worth USD 357.28 Billion by 2034

Read More News : Steel Rebar Market Size to Surpass USD 426.51 Billion by 2034

Read More News : Metal Stamping Market Size to Worth USD 385.66 Billion by 2035

Types of Steel

As an alloy, steel can be enhanced with different amounts of different chemical elements, resulting in more than 3,500 different steel grades, each with its unique properties. However, these grades are typically grouped into four different types of steel:

- Carbon Steel : Carbon steel got its name because it’s primarily made of iron and carbon, with a minute and negligible traces of other elements. The resulting material is exceptionally strong but very susceptible to corrosion. Carbon steel is further categorized according to its carbon content into low-carbon or mild steel, medium-carbon steel, and high-carbon steel.

- Alloy Steel : Alloy steels are made by mixing carbon steels with alloying elements that give steel distinct qualities. These elements include chromium, cobalt, molybdenum, nickel, tungsten, vanadium, and traces of other alloying elements.

- Tool Steel : Tool steels are known for their exceptional hardness and high-temperature resistance, which is why they’re used to produce various tools, including ones that would cut through other types of steel.

- Stainless Steel : Stainless steel is probably the best-known steel on the market and one of the most widespread steels used in industries with high hygienic requirements due to its corrosion resistance. This is achieved by adding at least 10% of chromium to the iron-carbon mixture, resulting in steel that’s suitable for aerospace, medical equipment, residential application, cookware, etc.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6027

Iron And Steel Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 1.92 Trillion |

| Revenue forecast in 2035 | USD 2.95 Trillion |

| Growth Rate | CAGR of 15.75% from 2026 to 2035 |

| Market size volume in 2025 | 7,329.51 million tons |

| Volume forecast in 2030 | 10,953.98 million tons |

| Growth Rate | CAGR of 3.25% from 2026to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2020 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative Units | Volume in kilotons, Revenue in USD million, and CAGR from 2026 to 2035 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Steel Type, By Production Method, By Application, By End-User Industry, By Region |

| Regional scope | North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa |

| Country scope | U.S; Canada; Mexico; Germany; UK; France; Spain; Italy; Russia; Turkey; India; China; Japan; South Korea; Argentina; Brazil; Iran |

| Key companies profiled | Arcelor Mittal S.A., China BaoWu Steel Group Corporation Limited; Nippon Steel Corporation; HBIS Group; Jiangsu Shagang Group; POSCO HOLDINGS INC.; Tata Steel; JFE Steel Corporation; Shougang Group; Nucor Corporation; JSW; SAIL; NLMK; Techint Group; U.S. Steel Corporation |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Forging the Future: How AI is Transforming the Iron and Steel Industry

Artificial intelligence is revolutionizing the iron and steel industry by enhancing efficiency, reducing operational costs, and improving product quality. AI-powered predictive maintenance helps prevent equipment failures in blast furnaces and rolling mills, minimizing downtime and production losses. Advanced algorithms optimize raw material usage, energy consumption, and process parameters, leading to higher yields and lower emissions. AI-driven supply chain management enables better demand forecasting, inventory control, and logistics planning, ensuring timely delivery of steel products.

Private Industry Investments in the Iron and Steel Industry:

- ArcelorMittal Nippon Steel India (AM/NS India) is establishing a new integrated steel mill in Andhra Pradesh with a planned capacity of about 7 million tonnes per annum to meet rising domestic demand.

- JSW Steel and South Korea's POSCO are exploring a joint venture to set up a 6 MTPA integrated steel plant in India, with Odisha being a key location under consideration.

- Tata Steel is investing approximately $2 billion toward decarbonizing its European plants and achieving its net-zero emissions goal by 2045.

- H2 Green Steel (a Swedish company backed by private equity) has invested $3 billion in a new plant in Brazil focused on producing steel using green hydrogen, a method that is carbon-free.

- TPG Growth (a private investment firm) committed $1.6 billion to build the Big River Steel facility in Arkansas, which is an advanced steel mini-mill focused on producing a wide product spectrum including automotive and electrical steels.

What are the Key Trends of the Global Iron and Steel Market?

- Accelerated Push for Decarbonization and "Green Steel"

The industry faces immense pressure from regulators and consumers to reduce its significant carbon footprint. This has led to major investments in low-emission technologies, such as hydrogen-based steelmaking and increased use of Electric Arc Furnaces (EAFs) that rely heavily on recycled scrap metal and renewable energy sources.

- Digital Transformation and Industry 4.0 Adoption

Steelmakers are increasingly integrating advanced technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and automation to optimize operations. These digital solutions enhance efficiency, enable predictive maintenance to reduce downtime, and improve overall product quality and supply chain management.

- Shifting Global Demand Centers and Trade Dynamics

While established markets in Europe and North America focus on specialized high-strength steels and sustainability, the primary growth in steel demand is shifting towards emerging economies, especially India and Southeast Asia, driven by rapid urbanization and massive infrastructure projects. This growth, however, is often affected by geopolitical tensions, trade protectionism, and fluctuating raw material prices.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6027

Iron and Steel Market Segmentation Insights

Product Type Insights

The finished steel segment dominated the market in 2025 because end-use industries increasingly demanded ready-to-use steel products that reduce processing time and enhance project efficiency. Construction, automotive, machinery, and energy sectors relied heavily on finished steel forms such as sheets, coils, bars, and structural components to support faster manufacturing and installation. Rising global infrastructure development and industrial expansion drove the need for high-quality, standardized finished steel to meet strict performance and safety requirements.

The direct reduced iron (DRI) is the second-largest product, leading the market due to its growing importance as a cleaner, low-carbon alternative to traditional blast-furnace ironmaking. Increasing global pressure to decarbonize steel production encouraged mills, especially those using electric arc furnaces, to adopt DRI for its lower emissions and consistent quality. The expanding availability of natural gas and the rise of hydrogen-based DRI technologies further strengthened its appeal as a sustainable feedstock.

Steel Type Insights

The carbon steel segment led the market in 2025 because it remained the most widely used and cost-effective material across construction, automotive, machinery, and energy applications. Its versatility, strength, and ease of fabrication made carbon steel the preferred choice for structural components, pipelines, and industrial equipment. Rapid infrastructure development and urban expansion in emerging economies significantly increased demand for carbon steel products such as rebars, beams, and sheets.

The AHSS & advanced alloy steel segment is expected to grow fastest over the forecast period due to rising demand from the automotive industry for stronger, lighter materials that improve fuel efficiency and meet strict safety regulations. Automakers increasingly adopted AHSS for vehicle body structures, crash components, and lightweight designs without compromising strength. Advanced alloy steels were also essential for high-performance machinery, energy systems, and industrial equipment requiring superior durability and heat resistance.

Production Method Insights

In 2025, the basic oxygen furnace (BOF) segment led the market because it remained the most efficient and high-volume method for producing primary steel, especially in regions with strong demand for construction and automotive-grade steel. BOF technology allowed steelmakers to convert iron ore into high-quality steel at large scales, supporting rapid output to meet global infrastructure and manufacturing needs. Its ability to produce a wide range of steel grades made it indispensable for industries such as construction, automotive, energy, and heavy machinery

The electric arc furnace (EAF) segment is the second-largest segment, leading the market due to its superior energy efficiency, lower operating costs, and ability to use scrap steel as the primary raw material. Growing global emphasis on decarbonization and sustainability pushed steelmakers to adopt EAF technology, which produces significantly fewer carbon emissions than traditional BOF methods. The rising availability of high-quality scrap metal and advancements in EAF technology enabled consistent production of high-grade steels for automotive, construction, and machinery applications.

Application Insights

The construction & infrastructure segment led the market in 2025 due to massive global investments in roads, bridges, railways, airports, and urban development projects. Rapid urbanization in emerging economies significantly increased demand for structural steel, rebars, and long products essential for large-scale construction. Governments prioritized infrastructure modernization and smart city initiatives, further boosting steel consumption. The segment also benefited from steel’s durability, versatility, and cost-effectiveness compared to alternative building materials.

The automotive & energy sectors segment is the second-largest segment, leading the market due to rising global vehicle production and the growing need for durable, high-performance steel in power generation and energy infrastructure. Automakers increasingly used advanced high-strength steels to meet fuel efficiency, safety, and emission standards, boosting demand across passenger and commercial vehicles. At the same time, the energy sector expanded investments in pipelines, transmission towers, wind turbines, and power plants, all of which require specialized alloy and carbon steels.

End-user Industry Insights

The commercial construction segment dominates the market due to the surge in infrastructure development, including offices, retail complexes, hotels, and mixed-use buildings across emerging and developed economies. Rapid urbanization and rising investments in smart cities increased the need for structural steel, reinforcement bars, and high-strength steel products. Commercial builders preferred steel for its durability, flexibility, and faster construction timelines compared to traditional materials.

The OEMs (automotive, machinery) is projected to fastest growth in the market due to rising global production of vehicles, industrial equipment, and heavy machinery. Automakers increasingly relied on high-strength and lightweight steel grades to meet fuel efficiency, safety, and emission standards. Machinery and equipment producers boosted demand for durable alloy and carbon steels needed for gears, engines, frames, and precision components. Rapid industrialization and automation in emerging economies further accelerated the need for reliable steel inputs across factory equipment and manufacturing systems.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

Asia Pacific: The Powerhouse Steering the Global Iron & Steel Frontier

The Asia Pacific iron and steel market size was valued at USD 1.19 Tillion in 2025 and is expected to reach USD 1.92 Tillion by 2035, growing at a CAGR of 4.90% from 2025 to 2035.

The Asia-Pacific dominated the market with nearly 70% share in 2025 due to its massive industrial base, rapid infrastructure expansion, and the world’s largest construction and manufacturing hubs concentrated in China, India, Japan, and South Korea, which collectively drive unprecedented steel consumption. The region benefits from abundant raw materials, large-scale low-cost production, and government-backed investments in transport, urbanization, renewable energy, and automotive sectors, further strengthening its global leadership.

India Iron and Steel Market Trends

India’s market in 2025 is driven by strong infrastructure expansion, sustained growth in construction activities, and rising demand from automotive, engineering, and capital goods industries. Government initiatives such as “Make in India,” the National Steel Policy, and massive investments in transportation, housing, and renewable energy projects are boosting domestic steel consumption. The country is also rapidly expanding its production capacity through both BF-BOF and EAF/DRI routes, supported by improved raw material availability and technological upgrades.

Middle East & Africa: The Next-Big Leap in Global Iron & Steel Momentum

The Middle East & Africa region is witnessing the fastest growth in the market as rapid urban development, large-scale infrastructure projects, and heavy investments in energy, transportation, and construction fuel soaring steel demand. Countries such as Saudi Arabia, the UAE, Egypt, and South Africa are accelerating mega-projects, from smart cities and industrial corridors to renewable energy parks, that require high steel consumption. At the same time, expanding manufacturing capabilities, abundant natural resources, and government-driven economic diversification programs are boosting regional steel production.

The UAE Iron and Steel Market Trends

The UAE market in 2025 is characterized by strong demand driven by large-scale infrastructure projects, ongoing urban development, and continued investments in construction linked to tourism, logistics, and industrial expansion. The country’s focus on diversifying its economy beyond oil, supported by initiatives like Dubai 2040 Urban Master Plan and Abu Dhabi’s industrial strategy, is fueling consumption of structural steel, rebar, and high-strength materials.

Top Companies in the Iron and Steel Market & Their Offerings

- HBIS Group: Offers a wide range of high-end plates, pipes, and special steel bars for automotive and construction use.

- Jiangsu Shagang Group: Specializes in producing construction steel, rebar, and hot-rolled coils for the construction, shipbuilding, and automotive sectors.

- POSCO HOLDINGS INC.: Globally manufactures and sells diverse integrated steel products, including hot/cold rolled and stainless steel.

- Tata Steel Limited: An integrated producer of finished steel products (tubes, wires, branded construction materials) for automotive and packaging sectors.

- JFE Steel Corporation: Provides a diverse lineup of high-quality sheets, plates, pipes, and structural shapes for automotive, energy, and construction industries.

- Shougang Group: Focuses on high-tech products like high-strength steel for aerospace, military, and high-speed rail applications.

- China BaoWu Steel Group Corporation Limited: Manufactures carbon, special, and stainless steel for transportation, energy, and aerospace industries.

Recent Breakthrough in the Iron and Steel Industry

- In February 2025, a Rs. 1,00,000 crore (US$11.60 billion) investment was announced by JSW Group for setting up a 25 MT steel plant on the Gadchiroli district of Maharashtra over seven to eight years. This project to set to become the world’s largest and most cost-effective project.

- May 2025 : Nippon Steel Corporation and Nakayama Steel Works signed a agreement to form a joint venture for building and operating an Electric Arc Furnace (EAF) and to establish a long-term business alliance

- November 2024 : Gerdau agreed to acquire the remaining stakes of 39.53% and 1.74% in Gerdau Summit from Sumitomo and Japan Steel Works, respectively, for USD 32.6 million, aiming for full ownership

- October 2024 : ArcelorMittal agreed to purchase Nippon Steel's 50% stake in the AMNS Calvert joint venture in Alabama for nominal payment of USD 1, contingent upon Nippon Steel's acquisition of U.S. Steel

- February 2024 : Nucor's Board approved $860 million for constructing a 650,000-ton-per-year rebar micro mill in the Pacific Northwest, expected to be completed in two years, pending regulatory approvals

- July 2022 : ArcelorMittal introduced the R340 crane rail grade steel, produced through customized microalloying in its chemical composition, a specific rolling process, and air cooling. The new R340 steel grade offers enhanced hardness and mechanical properties

More Insights in Towards Chemical and Materials:

- Carbon Steel Market : The global carbon steel market size is calculated at USD 1,072.38 billion in 2025 and is predicted to increase from USD 1,129.53 billion in 2026 and is projected to reach around USD 1,802.47 billion by 2035, The market is expanding at a CAGR of 5.33% between 2026 and 2035.

- Green Steel Market : The global green steel-market size was valued at USD 718.55 billion in 2024, grew to USD 763.10 billion in 2025, and is expected to hit around USD 1,311.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.20% over the forecast period from 2025 to 2034.

- Flat Steel Market : The global flat steel market size accounted for USD 687.55 billion in 2024 and is predicted to increase from USD 724.33 billion in 2025 to approximately USD 1,157.84 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034.

- Stainless Steel Market : The global stainless steel market size was valued at USD 216.85 billion in 2024 and is expected to hit around USD 357.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.12% over the forecast period from 2025 to 2034.

- Structural Steel Market : The global structural steel market size was approximately USD 119.12 billion in 2025 and is projected to reach around USD 188.63 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.24% between 2025 and 2034.

- Steel Rebar Market : The global steel rebar market stands at 368.91 million tons in 2025 and is forecast to reach 530.10 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period from 2025 to 2034.

- Hot Rolled Coil (HRC) Steel Market : The global hot rolled coil (HRC) steel market size accounted for USD 355.42 billion in 2024, grew to USD 375.86 billion in 2025, and is expected to be worth around USD 621.65 billion by 2034, poised to grow at a CAGR of 5.75% between 2025 and 2034.

- Steel Rebar Market : The global steel rebar market size was estimated at USD 257.87 billion in 2025 and is predicted to increase from USD 272.70 billion in 2026 to approximately USD 426.51 billion by 2034, expanding at a CAGR of 5.75% from 2025 to 2034.

- Stainless Steel Market : The global stainless steel market stood at approximately 14.19 million tons in 2025 and is anticipated to be likely to reach approximately 21.51 million tons in 2034. growing at a CAGR of 4.73% from 2025 to 2034.

- Asia Pacific Steel Rebar Market : The Asia Pacific steel rebar market size was reached at USD 142.16 billion in 2024 and is expected to be worth around USD 248.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.76% over the forecast period 2025 to 2034.

- Europe Steel Rebar Market : The Europe steel rebar market size was valued at USD 145.11 billion in 2024 and is expected to hit around USD 224.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period from 2025 to 2034.

- U.S. Steel Rebar Market : The U.S. steel rebar market size was estimated at USD 7.31 billion in 2025 and is predicted to increase from USD 7.70 billion in 2026 to approximately USD 11.59 billion by 2034, expanding at a CAGR of 5.25% from 2025 to 2034.

Iron and Steel Market Top Key Companies:

- Arcelor Mittal S.A.

- China BaoWu Steel Group Corporation Limited

- Nippon Steel Corporation

- HBIS Group

- Jiangsu Shagang Group

- POSCO HOLDINGS INC.

- Tata Steel Limited

- JFE Steel Corporation

- Shougang Group

Iron and Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Iron and Steel Market

By Product Type

- Iron

- Pig Iron

- Direct Reduced Iron (DRI)

- Sponge Iron

- Steel

- Crude Steel

- Finished Steel (Flat + Long Products)

- Ferroalloys

- Ferrochrome

- Ferromanganese

- Ferrosilicon

By Steel Type

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Tool Steel

- Advanced High-Strength Steel (AHSS)

By Production Method

- Basic Oxygen Furnace (BOF)

- Electric Arc Furnace (EAF)

- Open Hearth (residual/legacy)

- Induction Furnace

By Application

- Construction & Infrastructure

- Automotive & Transportation

- Machinery & Heavy Equipment

- Energy (wind, oil & gas, power)

- Shipbuilding

- Appliances & Consumer Goods

- Packaging (steel cans, drums)

By End-User Industry

- Commercial Construction

- Residential Construction

- Industrials & Manufacturing

- OEMs (Automotive, Machinery)

- Utilities & Energy

- Defense & Marine

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6027

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/